Your Local Broker, Internationally

Berthon UK

(Lymington, Hampshire - UK)

Sue Grant

sue.grant@berthon.co.uk

0044 (0)1590 679 222

Berthon Scandinavia

(Henån, Sweden)

Magnus Kullberg

magnus.kullberg@berthonscandinavia.se

0046 304 694 000

Berthon Spain

(Palma de Mallorca, Spain)

Simon Turner

simon.turner@berthoninternational.com

0034 639 701 234

Berthon USA

(Rhode Island, USA)

Jennifer Stewart

jennifer.stewart@berthonusa.com

001 401 846 8404

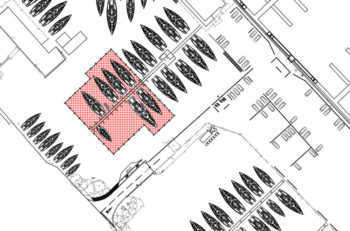

Berthon’s Customs Warehouse

The Berthon Customs Warehouse has been approved by HM Revenue and Customs and set up under their guidance. It is a secure area where yachts that are ex-VAT are stored and can be offered for sale. On sale there are various options –

- If a European National purchases the yacht for use in the EU, the yacht should be exported on sale to the EU and VAT accounted for there

- If a UK National who is not intending to bring the yacht into use in the EU purchases her, the supply can be zero rated.

- If a UK national purchases the yacht for use in the UK, VAT must be returned to HMRC at closing.

All yachts offered for sale in the UK have to account for VAT. Customs warehousing exercises strict control over the yacht whilst for sale and enables this to occur.

Yachts coming into the Berthon Customs Warehouse must be correctly entered and Berthon will assist with these formalities. Yacht owners are asked to work with us to ensure that we observe the current HMRC regulations.

Yachts can be sea-trialled as part of the survey process under strict control.

If you would like to know more about placing your yacht in the Berthon Customs Warehouse or if you would like to talk about purchasing one of our ex-VAT yachts in the UK contact Sue Grant (sue.grant@berthon.co.uk).